vermont sales tax food

Sellers should collect Vermont Sales Tax on TPP delivered to destinations. Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines.

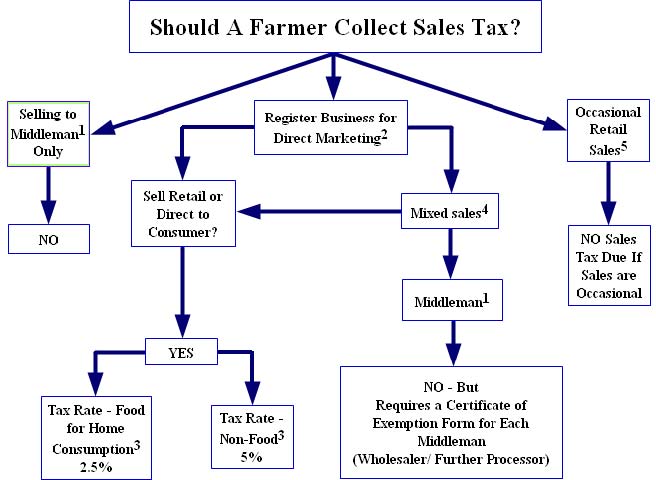

Direct Marketers And The Virginia Sales Tax

We have provided a table to help guide you on page 2.

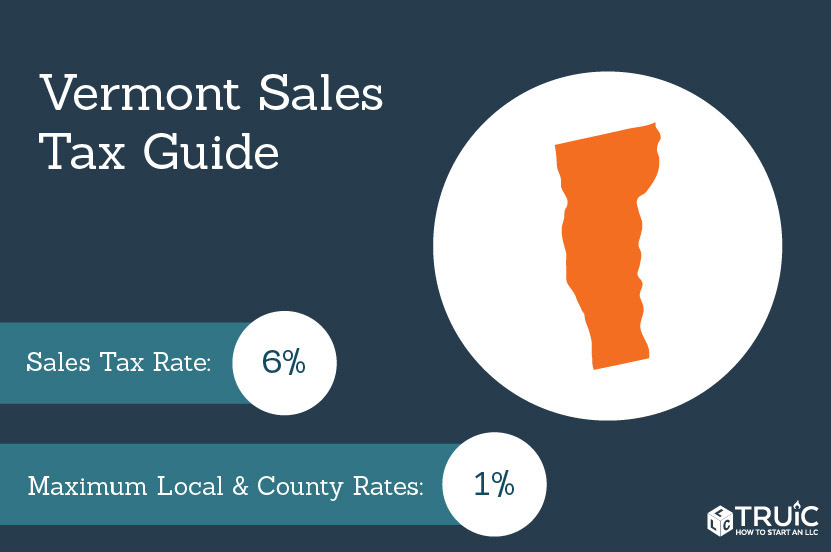

. It should be noted that any mandatory gratuities of up to 15 and all voluntary gratuities that are distributed to employees are not considered to be taxable. The maximum local tax rate allowed by Vermont law is 1. Sales Tax A sales tax of 6 is imposed on the retail sales of.

An example of an item that is exempt from Vermont sales tax are items which were specifically purchased for resale. SALES AND USE TAX Subchapter 002. Sales tax is destination-based meaning the tax is applied based on the location where the buyer takes possession of the item or where it is delivered.

Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Remember clothing is excluded.

Income Tax Purchases 1000000 - 2499900 1000 16667 2500000 - 3499900 2000 33333. Dollars 2 years ago. SNAP or food stamps are exempt from sales tax.

A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. Online store selling manufactured food cans and dry foods in all 50 states from a business unit with delivery local service Online retail sales last year US. 970131 and 54.

Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. The state sales tax rate in. The best way to determine whether a beverage falls under the definition of a soft drink is to read the product label.

Pet food or pet products. Dollars up from 256 billion US. In the state of Vermont they are exempt from any sales tax but are considered to be subject to the meals and rooms tax.

Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0092 for a total of 6092 when combined with the state sales tax. In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Soft drinks are subject to Vermont tax under 32 VSA.

Sellers should collect Vermont Sales Tax on TPP delivered to destinations. Vermont Sales and Use Tax Sales Tax. Through the streamlined sales tax agreement businesses get a uniform definition of taxable items and other benefits to reduce the burden of tax compliance.

Vermont Sales and Use Tax Sales Tax. Lowest sales tax 6 Highest sales. Learn more about streamlined sales tax.

Restaurant meals may also. In Vermont this is the 3SquaresVT program. Soft drinks however do not include milk or milkmilk substitute products or beverages that contain greater than 50 vegetable or fruit juice.

Businesses have a nightmare to maintain and track all the different nuances in the state sales tax code. 31 rows Vermont VT Sales Tax Rates by City. VERMONT SALES TAX With regard to the Vermont use tax question please review the following and let us know if you.

Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section 9771 of this title and the use tax imposed under section 9773 of this title. Vermont together with a majority of other states is a member of the streamlined sales tax project. 974113 with the exception of soft drinks.

The transfer of taxable tangible goods and services is subject to Vermont sales tax. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law. The Vermont Statutes Online.

The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. 286 rows 2022 List of Vermont Local Sales Tax Rates. Taxation and Finance Chapter 233.

E-commerce sales amounted to 289 billion US. To learn more see a full list of taxable and tax-exempt items in Vermont. What is streamlined sales tax.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Sales tax is destination-based meaning the tax is applied based on the location where the buyer takes possession of the item or where it is delivered. A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law.

Vermont Sales Tax ID Online Food Store Comments. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7.

9741 9741. Vermonts food and beverage sales tax exemption does not extend to soft drinks or sweetened beverages.

Sales Tax On Grocery Items Taxjar

Vermont Sales Tax Guide And Calculator 2022 Taxjar

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Ben Jerry S Ice Cream Recall Seven Layer Bars Ben And Jerrys Ice Cream Layer Bars

Truffle Time Food Foodie Creative People

Use Amazonsmile When You Shop Online And Amazon Will Make A Donation To Faact At No Cost To You Supportive Anaphylaxis Food Allergies

Readers Ask How Much Is Vt Deli Tax Cooking And Food Delivery

Pin By Terry Bryan On Christmas Gifts Coding Christmas Gifts Friendly

Vermont Sales Tax Small Business Guide Truic

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation